Liquidity management represents both cash management and float management each of which represent different challenges and require different solutions. The challenges for managing rural liquidity are greater simply because there are typically fewer agents, fewer customers, and fewer physical rebalancing points for agents to use. So, what can be done?

- Carefully design your channel – using a hybrid design offers increased flexibility (cash and float)

The first issue is in design of the agent channel – whether to use your own agents ‘on-us’, third party or shared agents ‘off-us’ or a combination of both. In many cases rural agents represent several mobile money and agent banking providers. Whilst representing several providers can make cash management easier – as all providers pull from the same available cash, it can make float management much more challenging – as typically floats are not shared. One solution here is to encourage the use of agent aggregators. In this case an aggregator manages multiple agents and can move float around as required.

- Understand rural cashflows and apply this knowledge in designing channels, products, and services

To manage liquidity, both cash and float – it is important to understand the cash flows in a specific area, when is cash required, when is it spent, where is cash required, where is cash spent? Is there a seasonality to cashflows, through the year or through the month? What is the magnitude of the cashflows? This understanding informs choice of agent, agent distribution strategy, aggregation, superagency, and the design of analytics around agency. Whilst this initial understanding will be partial, this understanding can develop significantly over time.

- Carefully chose, train and support your agents (cash and float)

The most important factor in a good agent network are the agents themselves. Choosing the right agents often means choosing agents who already operate businesses that generate and manage significant cash flows. These agents manage cash daily for their businesses, they are liquid. In rural areas they could be agro-dealers or local shops. The financial service provider must train agents and support them through visits, through call centres and where possible through products and services which assist the agents in their business activities. Agent apps should provide access to commissions earned.

- Use aggregators to help manage agent float levels (float)

Aggregators manage multiple agents and usually provide agents float when required, usually upon request from the agent. However, aggregators should go further and use monitoring software to detect where increased float may be required, in this way agent float levels are maintained. Novopay in India monitors thousands of agents’ float levels on a real time basis.

- Use data and analytics to predict likely demand for float and cash (cash and float)

Some movements in cash and liquidity are predictable. At agent level practical tools can be used such as the 1.5x stock rule which maintains that cash and float levels are kept at 1.5 times the previous days deposits and withdrawals. However, agents and aggregators should go further and predict likely demand for float and cash using historic data and knowledge of future events, festivals, month ends etc. to anticipate demand for float and cash.

- Use super-agents to create rebalancing points closer to agents (float and cash)

There are times when an agent has excess cash, insufficient float and needs to rebalance. This can be especially difficult in rural areas where there are few physical branches. There is no ideal solution to this, but part of the solution is to carefully develop a super-agent network. Super agents handle cash and can act as agent rebalancing points. They can be rural cooperatives, distributors, some fuel stations. Geo-mapping can help service providers to determine where to place their rebalancing points considering rural transport infrastructure and actual and proposed agent distribution.

- Watch for the local solutions that agents operate themselves (float and cash)

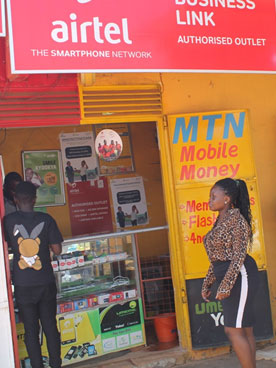

When travelling around rural Uganda it I common to find agents serving the two mobile networks Airtel Money and MTN. It is also common to find agents cooperating between themselves in managing float and cash – this tended to be for smaller amounts of money – but it appeared to be an active practice. Watching for the solutions that are developed locally, provides both insights on the challenges of float and cash management as well as potential solutions which can be scaled.

- Identify and design financial services for key actors and their businesses (float and cash)

Many agents are rural shopkeepers. A rural shop generates cashflow. The shopkeeper buys goods (sometimes on credit) and sells these goods most often for cash, (sometimes on credit). These cash and credit transactions influence the cash on hand, and the future transactions which the shopkeeper will make or receive. However, typically a rural shop will have a series of smaller cash receipts and then larger payments to make for stock to distributors. A financial service provider can identify and design working capital products to support their agents and payment services which enable agents to purchase stock using their surplus float.

- Design solutions to keep cash local (cash)

Historically cash in Kenya would move out to rural areas to facilitate commercial transactions with bulk cash management handled by the Central Bank of Kenya – distributing cash through the banking system. However, given the commercial centre was Nairobi, in a few transactions cash would make its way back to Nairobi – requiring cash to be recirculated continuously to rural areas. This was an expensive endeavour and carried significant risks.

These observations raise important questions –

- What transactions are being made between rural and urban areas?

- Which transactions are handled in cash?

- Which of these transactions can be handled through digital transactions whether mobile money, agent banking or account to account transactions?

- Are there opportunities to digitise or partially digitise value chains?