News & Updates

3rd Annual Microfinance and Savings Groups Conference 2025

The 3rd Annual Microfinance and Savings Groups Conference will be held on 10th and 11th November 2025 at Hotel Africana, Kampala. This annual event organised by Ministry of Finance, Planning and Economic Development in partnership with other stakeholders including...

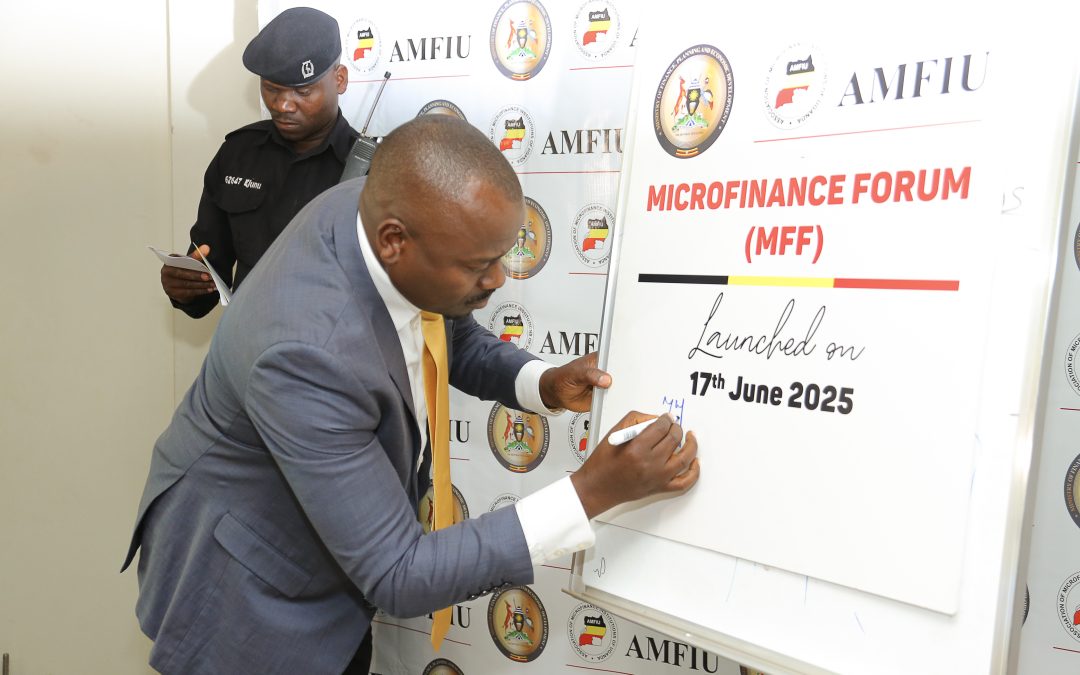

Uganda Re-launches the Microfinance Forum (MFF) to Strengthen Sector Coordination and Growth

Uganda’s microfinance sector marked a significant milestone with the re-launch of the Microfinance Forum (MFF) on June 17, 2025, in Kampala. The forum, a multi-stakeholder platform, is designed to foster stronger coordination, collaboration, and innovation within the...

Annual General Meeting (AGM) 2025

AMFIU would like to announce to all members that the Annual General Meeting (AGM) for this year will take place on 27th June 2025 at Mestil Hotel, Kampala, starting at 8:30 AM. The day will begin with a pre-AGM workshop featuring presentations from wholesale lenders...

EBO SACCO Receives License from Bank of Uganda

EBO SACCO has become the first cooperative to be officially licensed by Bank of Uganda. While receiving the license, Rosette Kashaija, Chairperson of EBO SACCO, expressed her excitement, emphasizing that this milestone marks the beginning of new opportunities for the...

Christmas message from the AMFIU Executive Director to the members and stakeholders

Dear Members and Stakeholders, I wish to begin by thanking the Almighty God for the great favor and grace He has bestowed upon us during this year. I would like to express my heartfelt gratitude to each and every one of you for your unwavering dedication and...

AMFIU Recognized for Contributing to Financial Inclusion in Uganda

Wakandi Uganda Limited, a Norwegian fintech company, recently honored the Association of Microfinance Institutions of Uganda (AMFIU) for its exceptional commitment to promoting financial inclusion in Uganda. Wakandi Uganda Limited is one of the fintechs that has...

AMFIU President’s Speech at the Microfinance and Savings Groups Conference 2024

As AMFIU we bring together sector players whose mandate is to provide financial services to the economically active poor, targeting vulnerable economic segments like the youth, women, refugees and people with disabilities all the greater population that continue to be...

Stakeholders discuss Pertinent Issues at the Microfinance and Savings Group Conference 2024

The microfinance stakeholders recently met to discuss pertinent issues at the Microfinance and Savings Group Conference 2024 organized by the Ministry of Finance, Planning and Economic Development (MoFPED) in collaboration with AMFIU and other stakeholders. The...

Microfinance and Savings Group Conference 2024

The National Microfinance and Savings Group Conference, has been organized by the Ministry of Finance Planning and Economic Development in collaboration with AMFIU and other stakeholders in the microfinance industry. The conference is scheduled to take place from 17th...

Annual General Meeting (AGM) 2024

AMFIU would like to announce to all esteemed members that the Annual General Meeting (AGM) for this year is scheduled to take place on 21st June 2024 at Hotel Africana in Kampala, starting at 8:30 AM. The theme for this year's AGM is 'Strengthening the microfinance...

Strengthening Microfinance Institutions in Eastern Uganda to Expand Access to Sanitation and Hygiene Products

In a strategic move to enhance access to improved sanitation and hygiene services in Eastern Uganda, AMFIU entered into a partnership with Water For People, a global organization committed to increasing access to safe water, sanitation, and hygiene (WASH) services....

Strengthening ESG Compliance: Insights from Jacqueline Mbabazi

During the recently concluded ESG workshop in Mbarara, Uganda, Ms. Jacqueline Mbabazi, Executive Director, AMFIU, delivered a keynote address on ESG requirements in East Africa. In her session, titled “ESG Requirements in East Africa: Regulatory Perspectives and...

AMFIU Business Consult builds capacity of 400 SACCOs and VSLA leaders

AMFIU Business Consult (ABC), the business arm of the AMFIU, recently successfully concluded the consultancy aimed at enhancing financial literacy and leadership capacity among Savings and Credit Cooperatives (SACCOs) and Village Savings and Loans Associations (VSLAs)...

UGX 28,196,332,673 disbursed by microfinance institutions towards Water and Sanitation

According to recent data, 27 AMFIU member institutions have disbursed a total of UGX 28,196,332,673 towards water and sanitation initiatives. As part of AMFIU's commitment to financial inclusion, the association is assisting its members in developing social loan...

Innovations to boost Agriculture financing in the Microfinance Sector

Agriculture financing has been a big challenge for the microfinance industry because of the various risks associated with it. However, recent years have seen an increase in the number of MFIs, donors and wholesale lenders interested in promoting agriculture financing....

Dissemination of AMFIU’s Agri-Finance Catalogue and Agriculture Product Prototype

AMFIU recently hosted a workshop to disseminate the findings of the Agri-Finance Catalogue and Agriculture product prototype. The national dissemination workshop served as a platform for engaging stakeholders, sharing knowledge, and gathering feedback on the developed...

Online Training Platform launched

AMFIU, known for its physical training sessions, has faced limitations in reaching a wider audience due to resource constraints. To overcome this challenge and enhance engagement with members, AMFIU has unveiled an innovative online training platform. This platform...

Refining agricultural products to increase uptake: Experience from 3 SACCOs in Western Uganda

Agriterra, in collaboration with SNV Netherlands Development Organization through the TIDE2 project is creating an environment that fosters access to more appropriate and sustainable access to agri-finance products. This is done through strengthening SACCOs to offer...

Microfinance Sector Performance Report 2023 (Download Now)

AMFIU Hosts Delegation from Nigeria’s National Association of Microfinance Banks (NAMB) for Water and Sanitation Learning Exchange

AMFIU recently hosted a high-level delegation from the National Association of Microfinance Banks (NAMB) of Nigeria on a benchmarking and learning visit focused on expanding access to water, sanitation, and hygiene (WASH) through microfinance. This visit follows...

VisionFund Uganda Shines at the VisionFund International Africa Simba Awards 2024

VisionFund Uganda recently demonstrated excellence and impact in the microfinance sector, securing multiple accolades at the prestigious Africa Simba Awards 2024 in Senegal. These awards recognize institutions driving financial inclusion and sustainable development...

Do you know the difference between a microfinance institution and a money lender?

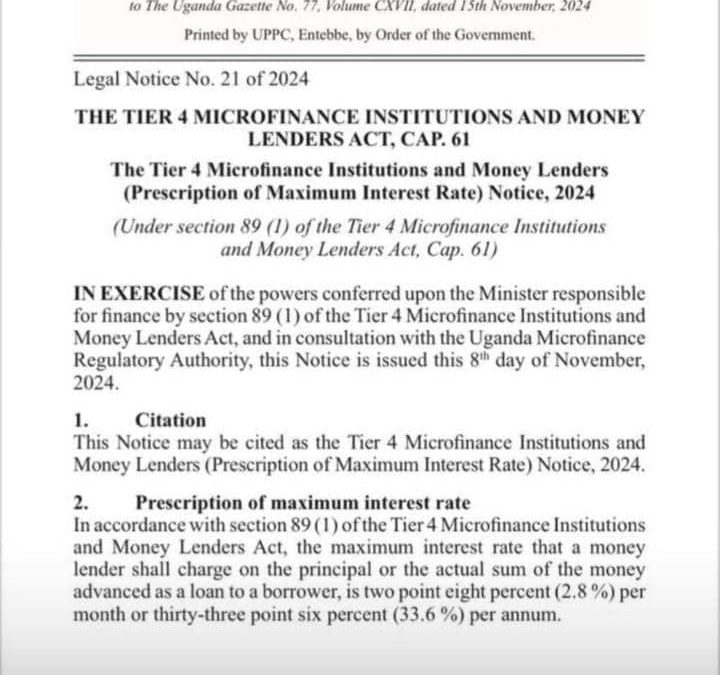

The recent government notice capping interest rates for money lenders brought back the long-shelved debt on the difference between a microfinance institution and a money lender. While some may argue that anyone who lends money is a money lender, it is crucial to...

Analysis of Legal Notice No. 21 of 2024: Capping the maximum interest rates for money lenders

We understand that AMFIU members are considering the application/effect of the Tier 4 Microfinance Institutions and Money Lenders (Prescription of Maximum Interest Rate) Legal Notice No. 21 of 2024, issued by the Minister of Finance, Planning and Economic Development...

AMFIU receives a Gender Equality Seal Awards from UNDP

AMFIU was honored to receive a Gender Equality Seal Award from the United Nations Development Programme (UNDP) and the Private Sector Foundation of Uganda (PSFU) during the recent Gender Equality Seal (GES) Awards ceremony. The GES Awards aim to acknowledge private...

Understanding sound practices in Microfinance

Sound practices are the ways of planning and doing things at policy, governance, managerial and operational levels that help Microfinance Institutions and other players in the microfinance industry to become more effective, efficient and to register enhanced...

SACCOs and MFIs Still Require Capacity Building in Delinquency Management

Findings from AMFIU’s recent research reveal that many SACCOs and Microfinance Institutions (MFIs) in Uganda continue to struggle with sustainability and profitability. Key challenges include poor governance, fraud by staff and board members, weak financial management...

Advancing ESG in Microfinance: Insights from the Soluti Finance East Africa ESG Workshop

Soluti Finance East Africa recently hosted a three-day ESG Workshop from October 15-17, 2024, in Mbarara, Uganda. The event brought together 59 leaders from 23 microfinance institutions (MFIs) to discuss practical approaches to embedding Environmental, Social, and...

Capacity Building in Cybersecurity for Member Institutions

In today’s digital landscape, microfinance institutions (MFIs) and SACCOs have become essential in delivering financial services to underserved communities. However, as these institutions increasingly embrace technology, they also face heightened vulnerabilities to...

Managing Liquidity for Digital Financial Services

Liquidity management represents both cash management and float management each of which represent different challenges and require different solutions. The challenges for managing rural liquidity are greater simply because there are typically fewer agents, fewer...

AMFIU and Strathmore Global Institute Sign MOU for the Development of Microfinance Professionals in Uganda

AMFIU entered a bilateral agreement with Strathmore Global Institute to drive financial inclusion in Uganda. This was during the signing of a memorandum of Understanding between two institutions at the Strathmore Global Institute offices in Kampala. During the event,...

Microfinance Tech Summit: Bridging the Gap Between Microfinance and Fintechs

The Financial Technology Service Providers Association (FITSPA) and the Association of Microfinance Institutions of Uganda (AMFIU) recently hosted the Microfinance Tech Summit, aimed at fostering collaboration and innovation in the sector. The summit focused on...

AMFIU Hosts Together for Inclusion (TOFI) Partners for a Learning Visit

AMFIU had the honor of hosting Together for Inclusion (TOFI) Partners for a learning visit, where discussions centered around topics such as financial inclusion, microfinance models, linkages within inclusive economic empowerment platforms, and digital literacy in...

UGAFODE Microfinance collaborates with AMFIU to deliver financial literacy education to Refugees

UGAFODE Microfinance Limited (MDI) has partnered with AMFIU to provide financial literacy education to refugees in Nakivale Refugee Camp. The goal of this initiative is to support refugees and host communities in improving their financial management skills, engaging...

Study reveals low financial knowledge among persons with disabilities

AMFIU in partnership with opportunity bank recently conducted a study determine the level of financial literacy knowledge of persons with disability. The study was undertaken among the isave groups in eastern Uganda. Both quantitative and qualitative methodologies...