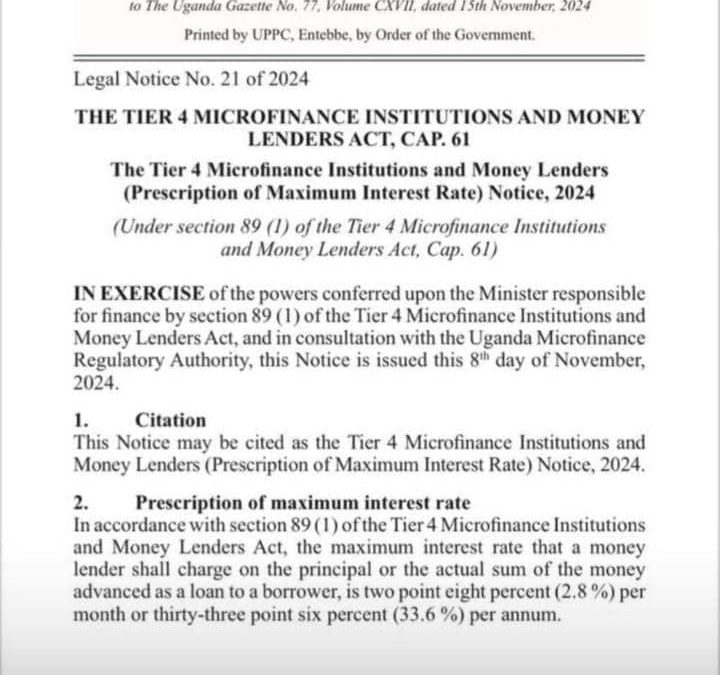

We understand that AMFIU members are considering the application/effect of the Tier 4 Microfinance Institutions and Money Lenders (Prescription of Maximum Interest Rate) Legal Notice No. 21 of 2024, issued by the Minister of Finance, Planning and Economic Development (”the Minister”), effective on the 15th day of November 2024. Please find below our advice regarding the same.

A. LAW APPLICABLE

In coming up with our view, we have considered the following laws:

i. The Tier 4 Microfinance Institutions and Money Lenders Act Cap 61 (“the Act”) as per the 7th Revised Edition of the Principal Laws effective 1st July 2024;

ii. The Tier 4 Microfinance Institutions and Money Lenders (Lending Conditions) Regulations S.I No. 8 of 2018 (“the Regulations”) ; and

iii. The (Tier 4 Microfinance Institutions and Money Lenders (Prescription of Maximum Interest Rate) Legal Notice No. 21 of 2024 (“the Legal Notice”)

B. APPLICATION

It is our view that the Legal Notice only applies to and affects money lenders as opposed to Tier 4 Microfinance Institutions, due to the following reasons:

a.1 Although the Act and regulations generally refer to both Tier 4 microfinance institutions and money lenders, Clause 2 of the Legal Notice makes specific reference to “the maximum interest rate that a money lender shall charge.” This is particularly straight forward and applicable to money lenders only.

Section 1 of the Act (Application of the Act) clearly specifies that the Act applies to (two delineated categories, that is:- ) Tier 4 Microfinance Institutions and Money Lenders.

a.2 By way of background, the Act clearly establishes, classifies and delineates the various entities regulated by the Act, namely:

i. Savings and Credit Cooperatives (Sections 35- 60; Part 111 of the Act);

ii. Non Deposit Taking Microfinance Institutions (Sections 61- 75; Part IV of the Act);

iii. Money Lenders (Sections 76- 97; Part V of the Act);

iv. Self Help Groups (Sections 98- 100; Part VI of the Act);

v. Commodity Based Microfinance (Sections 101-103; Part VII of the Act); and

vi. Islamic Microfinance (Sections 104- 106; Part VIII of the Act).

With the foregoing implies that the various entities have been specifically regulated differently as per the relevant specific categories. The Legal Notice has been issued by the Minister pursuant to Section 89 of the Act on control of interest rates- which particularly falls under part V of the Act, strictly applicable to Money Lenders.

a.3 It is important to note that the Interpretation Section of the Act ( Section 4) defines a Money Lender as a company licensed under Section 78 of the Act. This specific categorization further applies to Money Lenders and excludes Tier 4 Microfinance Institutions.

a.4 Further, Although the Legal Notice makes mention of both Trier 4 microfinance institutions and money lenders, Clause 2 of the Legal Notice makes specific reference to “the maximum interest rate that a money lender shall charge.” This is particularly straightforward and applicable to money lenders only.

a.5 As such, the citation of the Legal Notice emanates from the name of the Act itself. This does not necessarily mean that the Legal Notice affects both Money Lenders and Tier 4 Microfinance Institutions.

a.6 In terms of rules of statutory interpretation, the Golden rule is that where words should be interpreted literally unless there is an absurdity. The words making specific reference to the Money Lenders under the Act are clear, plain and straight forward and need no strained interpretation. Even if other rules of statutory interpretation were to be applied, it can be clearly said that the purpose of the Legal Notice is generally control interest rates and curb the mischief of unconscionable interest rates, largely associated with Money Lenders as opposed to Tier 4 Microfinance institutions.

a.7 The Legal Notice clearly indicates that it is made pursuant to Section 89 of the Act, regarding control of interest rates, again, with specific reference to money lenders. As such, it does not affect Tier 4 Microfinance institutions.

C. CONCLUSION

In effect, of the interest rate of Tier 4 Microfinance Institutions is not capped as the Legal Notice only applies to Money Lenders.