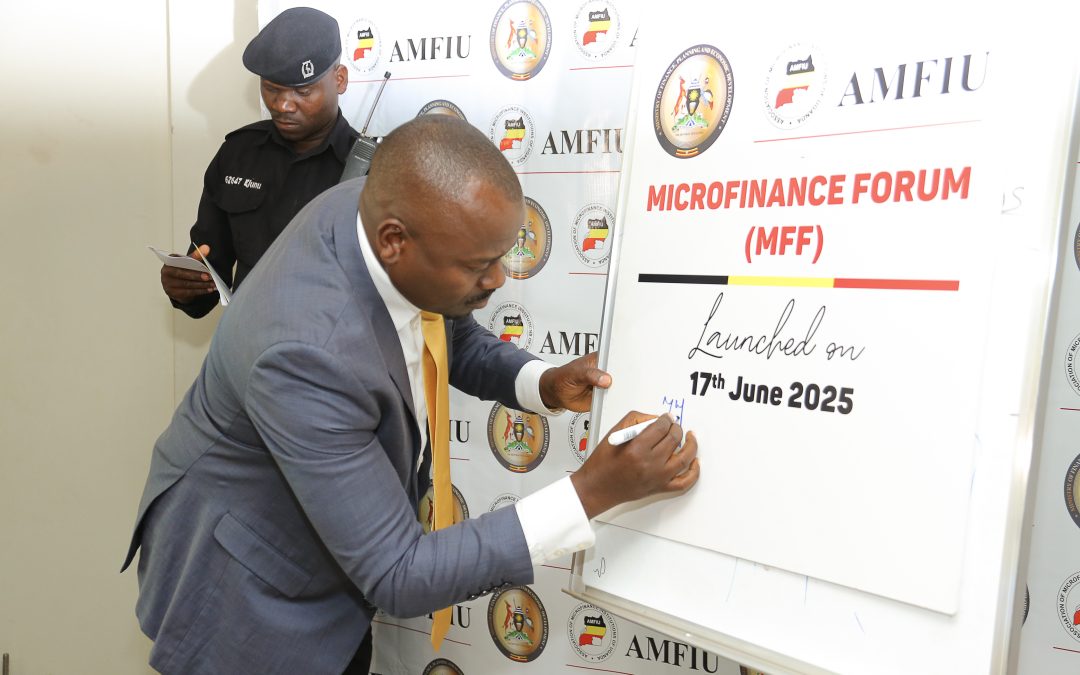

Uganda’s microfinance sector marked a significant milestone with the re-launch of the Microfinance Forum (MFF) on June 17, 2025, in Kampala. The forum, a multi-stakeholder platform, is designed to foster stronger coordination, collaboration, and innovation within the microfinance ecosystem.

The event, presided over by Hon. Haruna Kasolo Kyeyune, Minister of State for Microfinance and Small Enterprises, was organized by the Ministry of Finance, Planning and Economic Development (MoFPED) in partnership with the Association of Microfinance Institutions of Uganda (AMFIU) and other key stakeholders. AMFIU was formally designated as the Secretariat of the Forum, responsible for managing its day-to-day operations, technical coordination, and resource mobilization.

The MFF aims to build a robust, inclusive, and sustainable financial sector through policy dialogue, advocacy, capacity building, research, and strategic partnerships. Its re-establishment is a revival of a previously successful platform that contributed significantly to Uganda’s microfinance development during the late 1990s and early 2000s.

The earlier version of the Forum was instrumental in several sector achievements, including:

- The enactment of the MDI Act and initiation of discussions leading to Tier 4 regulations;

- The design of the Microfinance Outreach Plan, which later evolved into RFSP and subsequently PROFIRA;

- The development of the Performance Monitoring Tool (PMT), which is still widely used to date.

Reflecting on its legacy, Hon. Kasolo remarked, “Having served the longest term in the microfinance docket, it would have been a disservice to leave office without re-establishing this critical forum. I hope it will help address sector challenges, especially the unregulated practices by informal and digital money lenders who continue to exploit consumers.”

AMFIU’s Executive Director reiterated the Forum’s relevance, noting that it will serve as a central platform for dialogue, coordination, and knowledge sharing, structured around four core objectives:

- Advocacy and Regulatory Support – to influence a favorable legal and policy environment for microfinance institutions (MFIs) and savings groups.

- Knowledge Sharing and Innovation – to facilitate exchange of best practices and drive digital and financial innovations.

- Capacity Building and Professionalism – to strengthen institutional capabilities and promote ethical standards within the sector.

- Data-Driven Performance and Impact Measurement – to improve decision-making through evidence-based insights and improved sector linkages.

The Minister also called on stakeholders to rally behind key government initiatives such as the Parish Development Model (PDM) and Emyooga, noting that these are critical to improving household incomes and lifting communities out of poverty.

He concluded by reaffirming his support for the Forum: “This platform is a long-awaited vehicle for organized sector growth. I urge its leadership to champion savings culture and investment mobilization, which are fundamental for sustainable economic transformation.”

Mr. Moses Ogwapus, Commissioner for the Financial Services Department at MoFPED, shared his excitement: “This is the best day of my career. I’m truly excited and confident that the right leaders will take this forum to the heights we all envision.”

The event drew participation from a wide range of sector actors, including financial service providers, regulators, development partners, government institutions, academia, and independent consultants, all of whom expressed enthusiasm and commitment to revitalizing the microfinance sector through this collaborative platform.